Elliott Management guns for SoftBank

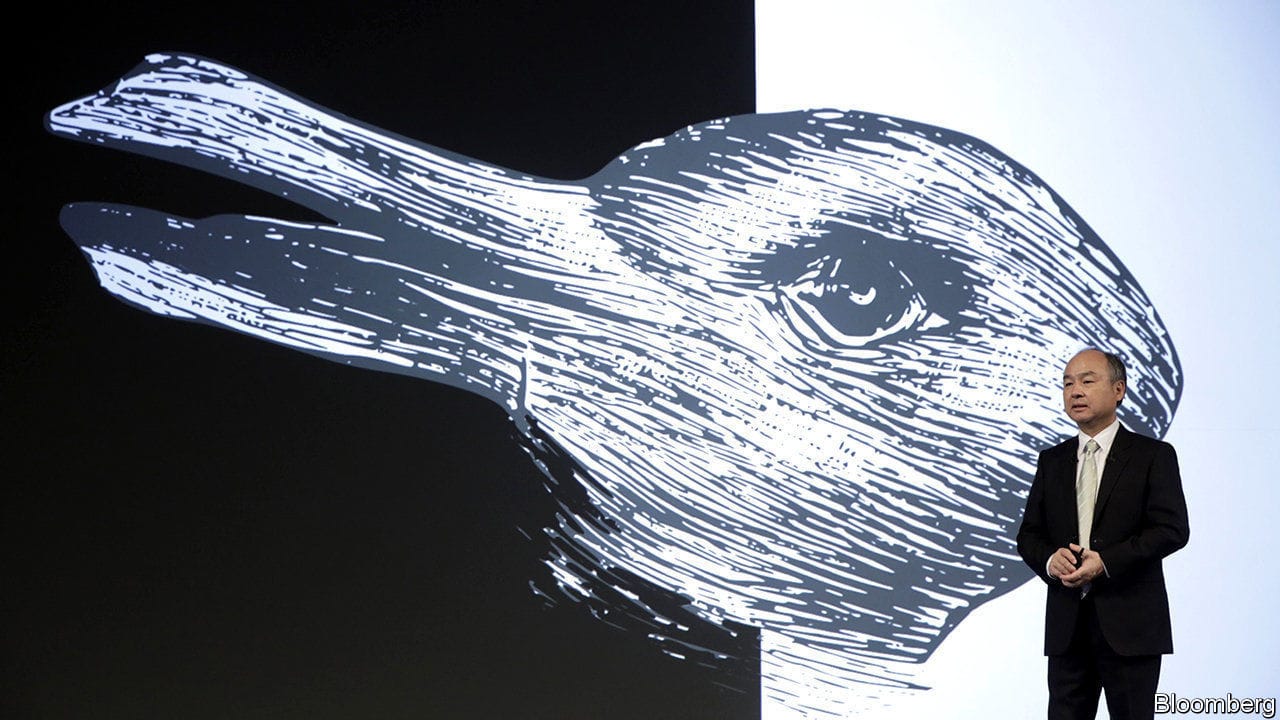

The activist investor wants the Japanese technology group to reform. Good luck

MOST BOSSES dread Elliott Management, an American activist hedge fund whose tactics the traumatised chairman of a German company once described as “psycho-terror”. After news leaked on February 6th that Elliott had taken a 3% stake, worth over $2.5bn, in SoftBank Group, a Japanese telecoms-and-tech conglomerate, its flamboyant founder, Son Masayoshi, seemed less perturbed. As he presented SoftBank’s results on February 12th, Mr Son professed to be “thankful that such a distinguished investor has joined us as a friend”. He has reason to sound welcoming. SoftBank’s languishing share price leapt by 7% on the news of Elliott’s stake.

This article appeared in the Business section of the print edition under the headline “Singer-Son time”

Business

February 15th 2020- The battle for the Middle Eastern arms market is heating up

- Burger King’s owner tries to regain its sizzle

- Admen have a clever new way to trick sports fans

- Elliott Management guns for SoftBank

- Youngsters’ job preferences and prospects are mismatched

- Chinese management schools are thriving

- American state capitalism will not beat China at 5G

From the February 15th 2020 edition

Discover stories from this section and more in the list of contents

Explore the edition

How Trump’s tariffs could crush American carmakers

They must hope the levies do not endure

The Economist’s office agony uncle is back

Another bulging postbag for Max Flannel

The smiling new face of German big business

From Allianz to Zalando, pedlars of services are outdoing industrial firms at home—and foreign rivals abroad

Airbus has not taken full advantage of Boeing’s weakness

That could leave a gap for other planemakers to fill

The business of second-hand clothing is booming

Can it be profitable, too?

Zyn is giving investors a buzz—for now

Nicotine pouches are growing fast