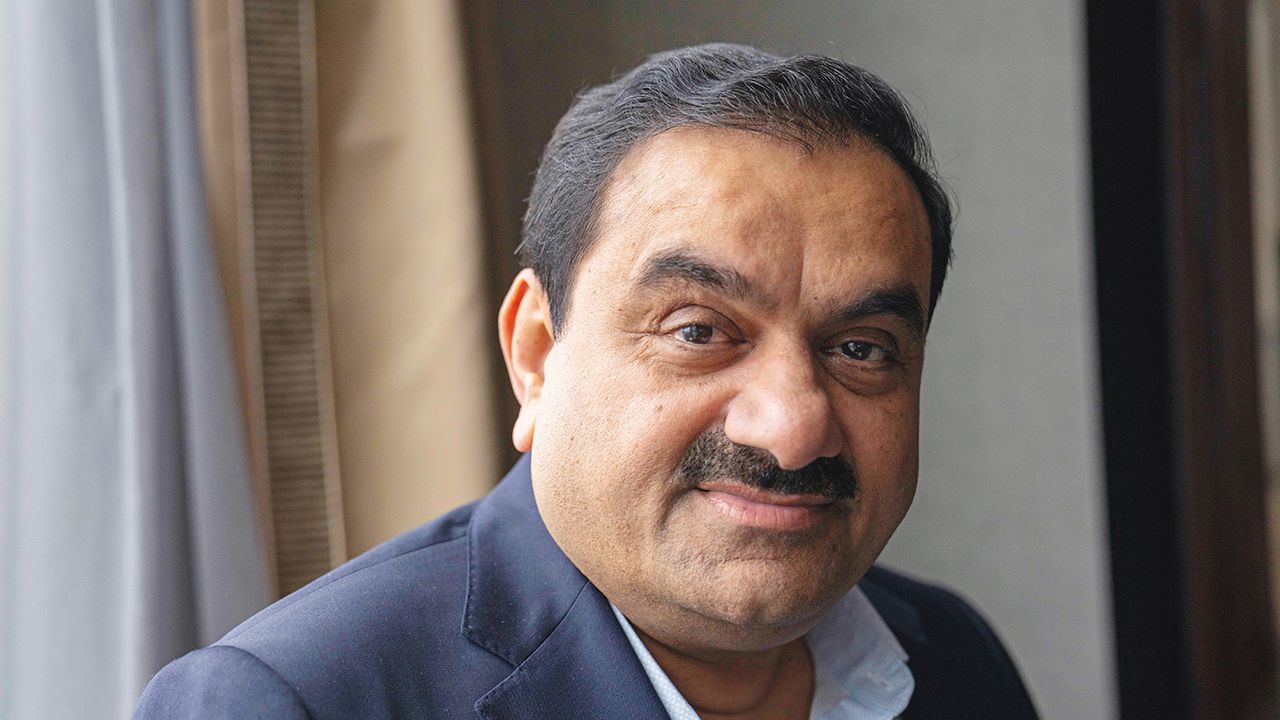

Nagging questions over the Adani empire won’t go away

A short-seller’s report raises uncomfortable questions for India’s policymakers, too

On the surface it was a huge mismatch—David versus an army of Goliaths. Yet in a matter of days a report by Hindenburg Research, a fledgling short-selling firm, resulted in a fall of over $50bn in the wealth of Gautam Adani, hitherto one of the world’s richest men and a close associate of Narendra Modi, India’s prime minister. Along the way, a $2.5bn share offering by Adani Enterprises, flagship of the Adani Group’s listed companies, was derailed. Hindenburg alleged that Adani is a giant con. Adani countered that the charges are baseless and, moreover, count as an attack on India itself.

This article appeared in the Leaders section of the print edition under the headline “Hindenburg v Adani ”

Leaders

February 4th 2023- Joe Biden’s effort to remake the economy is ambitious, risky—and selfish

- Nagging questions over the Adani empire won’t go away

- The Bank of Japan should stop defending its cap on bond yields

- Why the West’s oil sanctions on Russia are proving to be underwhelming

- Peru needs an early election and outside support, not interference

From the February 4th 2023 edition

Discover stories from this section and more in the list of contents

Explore the edition

A fantastic start for Friedrich Merz

The incoming chancellor signals massive increases in defence and infrastructure spending

The lesson from Trump’s Ukrainian weapons freeze

And the grim choice facing Volodymyr Zelensky

Western leaders must seize the moment to make Europe safe

As they meet in London, Vladimir Putin will sense weakness

Prabowo Subianto takes a chainsaw to Indonesia’s budget

The result? More money for the president’s boondoggles

Inheriting is becoming nearly as important as working

More wealth means more money for baby-boomers to pass on. That is dangerous for capitalism and society

Donald Trump has begun a mafia-like struggle for global power

But the new rules do not suit America