Just how mighty are active retail traders?

They are a force to be reckoned with. But most punters are still pretty boring

JUST TWO years ago the future of investing seemed to involve fewer and fewer people. Retail investors were piling into “passive” index funds, which track a broad basket of stocks for a tiny fee. Active fund managers, whether swaggering hedge-fund gurus or staid mutual-fund bosses, were in retreat as index and quantitative funds swelled. More automation seemed inevitable. A future in which human investors vanished altogether, replaced by slick, powerful machines swapping shares at near-lightspeed seemed just around the corner.

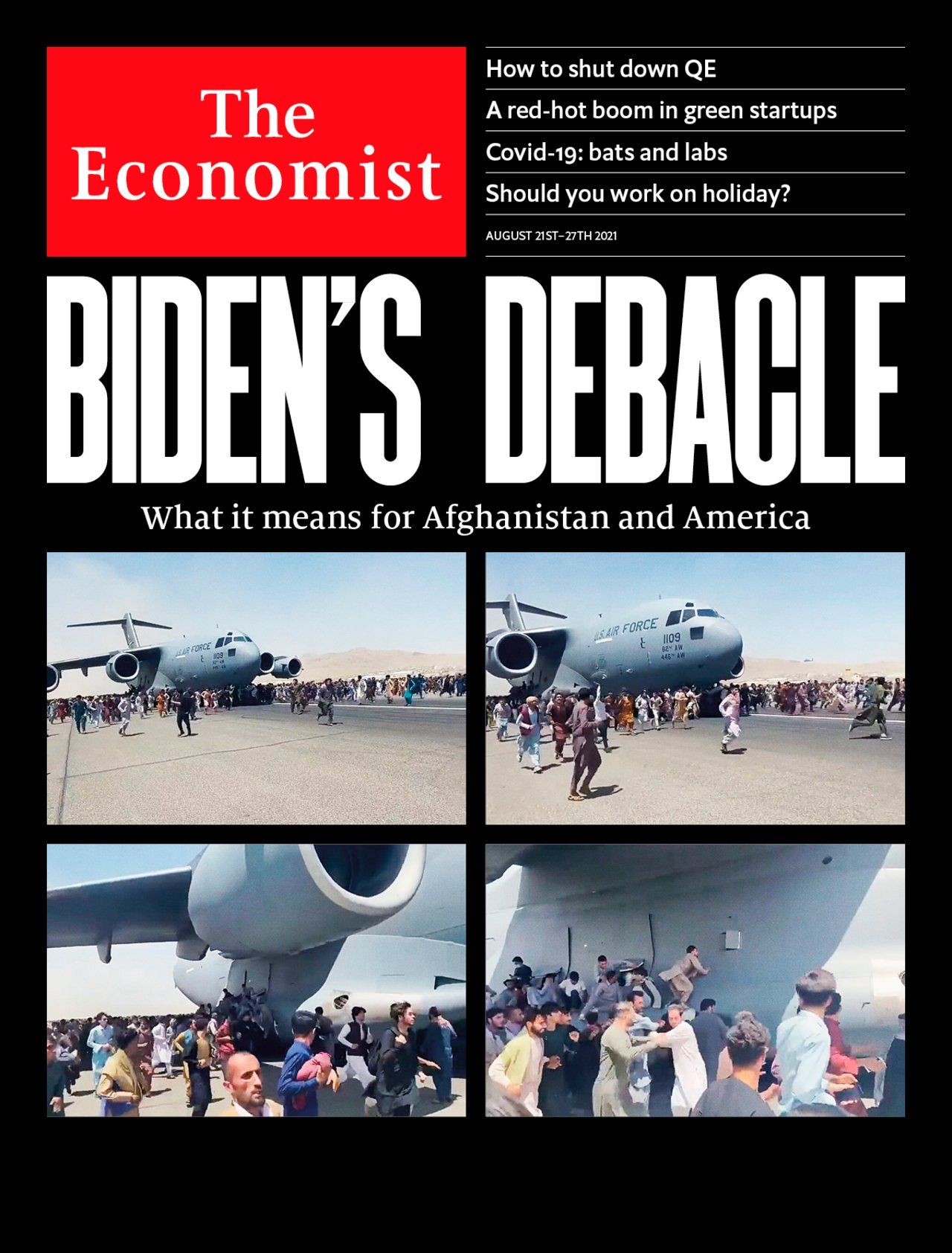

This article appeared in the Finance & economics section of the print edition under the headline “Jacks are all traders”

From the August 21st 2021 edition

Discover stories from this section and more in the list of contents

Explore the edition

Trump’s tariff turbulence is worse than anyone imagined

Even his concessions are less generous than expected

Why silver is the new gold

Safe-haven demand and solar panels have sent its price soaring

Trump’s new tariffs are his most extreme ever

America targets its three biggest trading partners: Canada, Mexico and China

El Salvador’s wild crypto experiment ends in failure

Its curtailment is the price of an IMF bail-out. And one worth paying

America is at risk of a Trumpian economic slowdown

Protectionist threats and erratic policies are combining to hurt growth

India has undermined a popular myth about development

Extreme poverty in the country has dropped to negligible levels