Central banks should ignore soaring energy costs

But they must continue fighting home-grown inflation

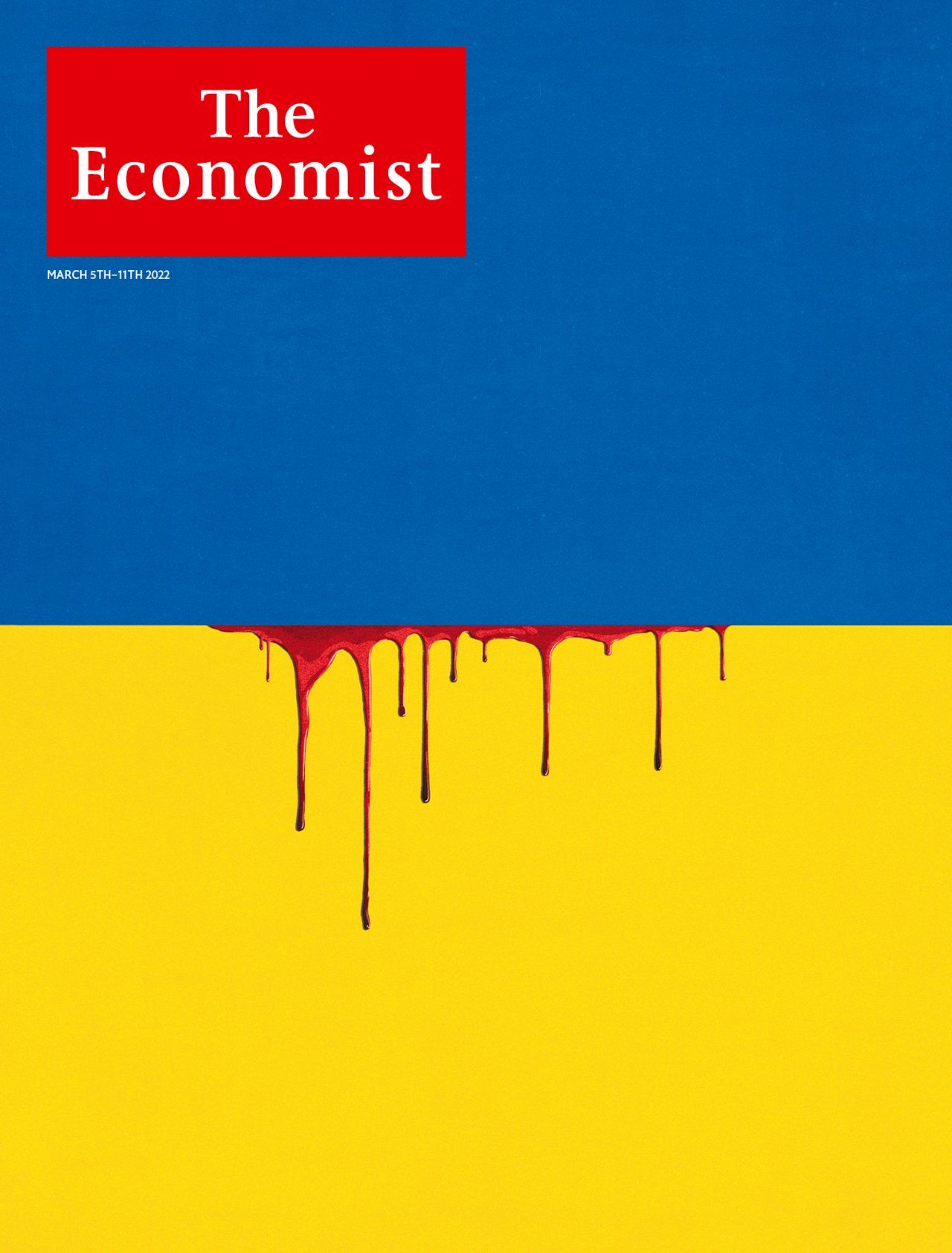

WAR IN UKRAINE has caused European natural-gas prices almost to double and sent oil prices soaring to over $115 a barrel. That has added to the inflation problem facing the world’s central banks. And more pain is probably coming. Western energy giants are getting out of Russia, sanctions are wreaking havoc on Russian commodities exports and the cancelling of the Nord Stream 2 gas pipeline from Russia to Germany will remove a potential source of relief. If Russian energy exports are cut off completely, the oil price could reach $150, rapidly boosting global consumer prices by another 2%.

This article appeared in the Leaders section of the print edition under the headline “War and price”

From the March 5th 2022 edition

Discover stories from this section and more in the list of contents

Explore the edition

A fantastic start for Friedrich Merz

The incoming chancellor signals massive increases in defence and infrastructure spending

The lesson from Trump’s Ukrainian weapons freeze

And the grim choice facing Volodymyr Zelensky

Western leaders must seize the moment to make Europe safe

As they meet in London, Vladimir Putin will sense weakness

Prabowo Subianto takes a chainsaw to Indonesia’s budget

The result? More money for the president’s boondoggles

Inheriting is becoming nearly as important as working

More wealth means more money for baby-boomers to pass on. That is dangerous for capitalism and society

Donald Trump has begun a mafia-like struggle for global power

But the new rules do not suit America